Copyright © 2025 - 吉莉數位遊牧中LUCKY NOMADS

[Digital Nomad Financial Management] From novice to Market watcher! Use the TradingView + Sanzhu stock system to understand US stocks and Taiwan stocks!

Hi! Dear friend Gilly, how are you today?

Gilly wants toHow to choose the right stock analysis toolFrom the perspective ofU.S. tariff policyCaused turmoil in the global stock market, andTaiwan stocks plunged more than 2,000 points at the opening of the market today, really isA bloody dayYeah! So Gilly wrote this to record this historic moment.

Some people sayIt's important to look at the earnings report, Some people insistTechnical analysis is king, But for me, choose a good oneStock analysis tools, in order to make investment easier.

In this article, I want to talk to you about two super practical stock analysis tools——TradingView and Sanzhu News。 The two have their own characteristics and are suitable for different investment styles. I hope they can help you find the most suitable analysis method for you!

Digital nomadic investment techniques: Can you choose stocks accurately without an office?

You don't have to keep an eye on the market every day for investment, especially for digital nomads like Gili. They may be in a coffee shop today or in another unknown location next week. Can't they keep guarding the computer all the time? At this time, a good oneStock analysis tools, Just like an investment assistant that you carry with you to help you keep abreast of market trends.

This article will introduce two stock analysis tools suitable for digital nomads:TradingView and Sanzhu News。

Why should digital nomads also understand technical analysis? Investment does not rely on luck alone!

The income methods of digital nomads are usually very diverse, May come from a fixed salary for remote work, or rely on case-taking work to obtain unstable income. Like thisIncome structure affects the motivation to invest。

If you have a stable source of income, you may choose to invest in low-risk index stocks regularly for a long time; but if your income is unstable, stock investment may be an additional source of income for you, or a way to capture short-term cash flow.

Therefore, learning technical analysis is not only to understand market trends, but also to help you find investment opportunities in volatile markets. Although it does not guarantee a stable income, it can help you make more favorable decisions in the short term, thereby increasing your investment income potential and giving you more choices in financial planning.

💡Jili Xiaoxiao reminds: There are gains and losses from investment risks, please invest carefully!

TradingView: The Global Vision of Digital Nomad Investors

TradingView is a cloud-based technical analysis tool, suitable for digital nomads moving around the world, no matter which country you are in, as long as you have the Internet, you can view market trends at any time.

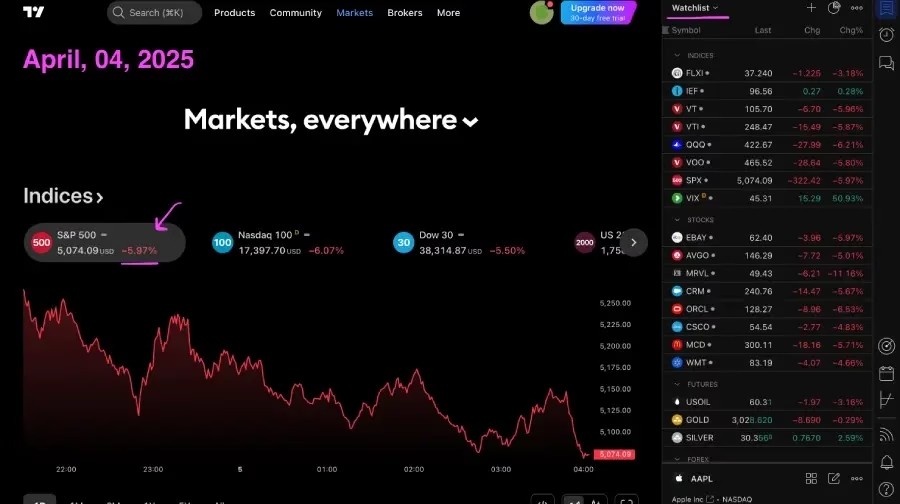

Graphic: On Friday, April 4, 2025, the S&P500 index fell by 5.97%, and other indexes also fell by more than 5%.

🔹 advantage:

✔ A variety of technical indicators, suitable for technical analysts

✔ Cloud storage, cross-device synchronization, switch between mobile phones and computers at any time

✔ Global market data, suitable for people who want to invest in the international market

📌 Suitable object: If you are a digital nomad who often moves between different countries, but want to master the global stock market, TradingView will be a good choice!

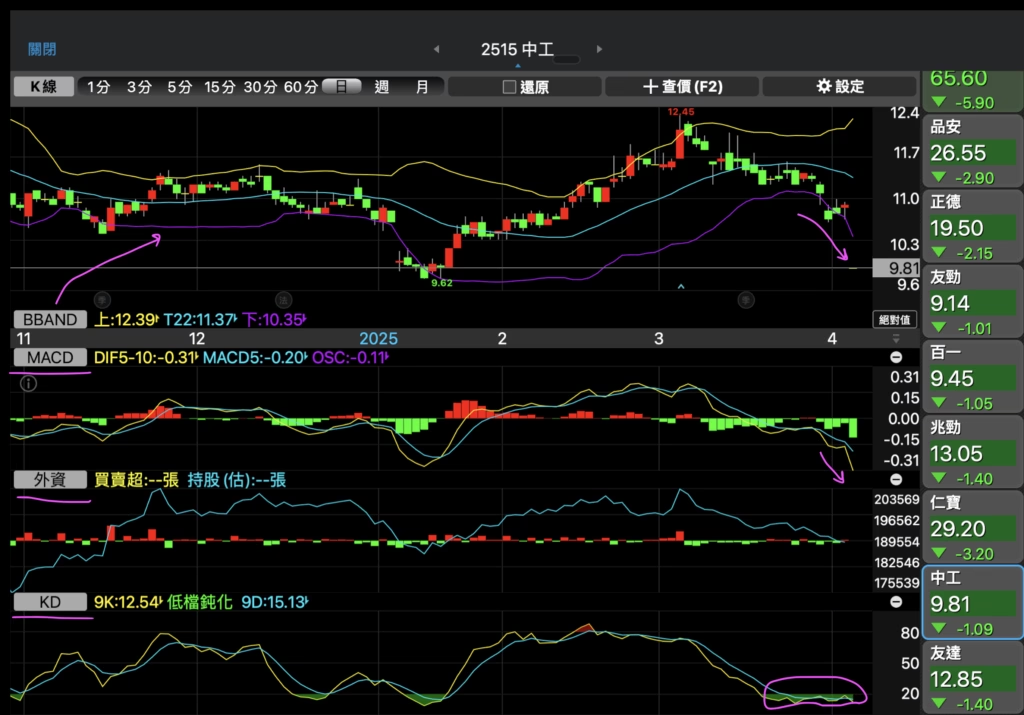

Graphic: Trend analysis of Taiwan stocks: Sinosteel.

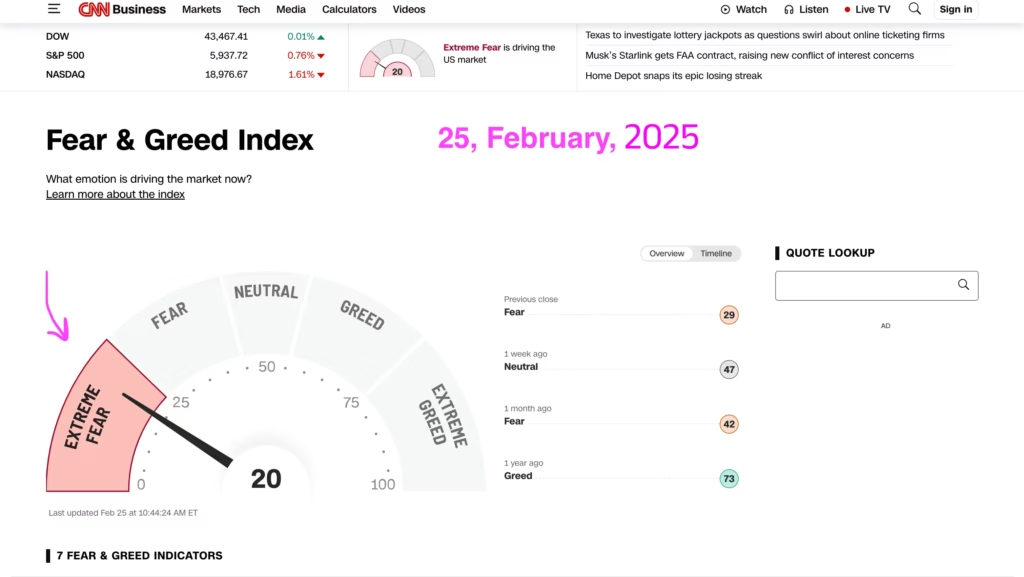

CNN Panic and Greed Index: On the road to digital nomadic investment, when the panic index falls below 4, are you ready?

When the backtesting ends on February 25, 2025, the fear index is 20, and panic in the market has already begun to brew. With the establishment of the tariff policy, investors' panic has also reached a climax.

"The market represents human nature! "--Famous quotes from the stock market

Illustration:✨Historic moment, Friday, April 4, 2025,Panic indexCome4。 ✨

In the investment field, the panic index will be regarded as aInverse indicatorfor reference. But when you really face it, can you be prepared (usually you have already made a risk plan and the layout of the capital level), so that your emotions are not easy to fluctuate with the market, and you can have enough cash as the basis for reinvestment.

"Others are greedy and I am afraid, others are afraid that I am greedy. "--Investment Master/Warren Buffett

Sanzhu Information: Suitable for digital nomads who follow Taiwan Stocks

If your investment scope is mainly Taiwan stocks, then Sanzhu Information is a localized analysis tool, especially suitable for Taiwanese investors.

🔹 advantage:

✔ Connect to a Taiwanese broker to place an order directly

✔ Provide instant Taiwan stock data, faster than ordinary free tools

✔ You can set a warning reminder to notify you when the stock reaches a specific price

📌 Suitable object: If you mainly invest in Taiwan stocks and don't want to miss any market news, Sanzhu Information is a good helper for you!

Essential for Digital nomad investors: Why can Taiwan stock chip analysis improve your investment decision-making?

The Taiwan stock market is small, and the main capital has a large impact, Through chip analysis, it can grasp the trends of large investors and improve the winning rate of investment. ButThe purchase of foreign capital does not fully represent a signal that stocks are beginning to rise.。 It may be a strategy to lure retail investors into the market. Therefore, chip analysis is a kind of reference material.Any technical analysis requires a long period of repeated accumulation of experience in judgment, testing and decision-making.。

Illustration: Take Sanzhu APP to analyze Taiwan stock-Zhengde as an example. For four consecutive days before April 2, 2025, foreign capital and investment trusts continued to buy signals, and the closing price on April 2 was 21.65 yuan. After the Qingming holiday, the stock market opened on Monday, April 7, 2025. Affected by the tariff policy, the stock market fell sharply, and the price of the stock also fell to 19.95 yuan.

Investment strategies in digital nomadic life: How to match technical indicators to accurately grasp the timing of buying and selling?

The Sanzhu stock system provides detailed information, including the main trading and the entry and exit of legal persons, to help determine the trend of stock prices. With technical indicators, such as MACD, KD indicators, and Bollinger Bands, it can further confirm the timing of buying and selling and improve the winning rate of trading.

Illustration: Analysis of Taiwan stocks: Zhonggong, with technical indicators MACD, KD, BBAND, and foreign investment chips for comprehensive judgment.

Understanding the flow of chips, such as changes in financing and the entry and exit of large players, helps to avoid risks and increase the probability of success.

Learning resources for Digital Nomad Investors: Stock Market Breaking News Reunion

Gilly doTaiwan stock investmentWhen using this platform to understand some trends and trends,The community is very active, Many investors in it are discussing dynamically in real time, or sharing technical teaching. There are currently Web and mobile apps, and the interface is designed to be very simple, but Jili chose to use APPS that are convenient to tie up, so she can watch it anytime, anywhere.

The trading mentality of digital nomads: Short-term investment is not just technology, but also to overcome these pitfalls!

Digital Nomadic Investment Strategy 1️️: How to use the price-quantity relationship to avoid market traps?

Short-term investors often encounter problems such as price and volume deviations and abnormal bargaining chips. They must make comprehensive judgments to avoid falling into market traps. The price-volume relationship is a key indicator. If the transaction volume does not match the price trend, it may be the main shipping signal.

Graphic: Analyzing the US stock SHAK (the recently well-known Shake Shack burger chain in the United States), after March 25, 2025, there will be a decline in inter-community prices and an increase in transaction volume. The so-calledPrice drop and volume increase。

Digital Nomadic Investment Strategy 2️️: Use the flow of chips to grasp the direction of the market and avoid risks

Chip analysis can make up for the blind spots of technical indicators, pay attention to the trends of legal persons and large investors, and avoid the traps of retail investors.Risk management is the core, and stop profit and stop loss points are set, To avoid emotions affecting transaction decisions and ensure the safety of funds.

Ji Li's Conclusion| The future of Digital Nomadic Financial Management: There is more than one way to invest, learn to analyze the market from multiple angles

The market is changing rapidly,Technical analysis is not a panacea, but an auxiliary decision-making tool, Make investment decisions more rational. Investing is like driving a car. You can't just look in the rear mirror, but also observe the current road conditions in order to avoid risks and move forward steadily.

Digital nomads should flexibly use a variety of analysis methods, combining technology, chips and fundamentals, to find the most suitable investment strategy for them. Regardless of the short-term or long-term, maintaining flexibility can make your finances more free and support your nomadic life!

Extended reading:

- 【Digital Nomad Financial Management】Start steadily from small white to steady! Gilly's Digital Nomad's Path to Financial Freedom

- 【數位遊牧財務攻略】巴菲特都在做的穩健理財法,你學會了嗎?《你沒有學到的資產配置:巴菲特默默在做的事》解析

- 【Digital Nomad Financial Management】《理財盲點: 有錢人不會做的十三種理財決定》:避開這 13 大財務陷阱,打造真正的遊牧自由

Have you ever used these two tools?

Are there other more recommended stock analysis tools?

Welcome to leave a message to share with Jili!